The South African rand has long been emblematic of the volatile yet resilient nature of emerging market currencies. While often quick to depreciate during global risk-off episodes, the rand has also shown a consistent ability to rebound - demonstrating both vulnerability and resilience. Its movements are influenced not just by local fundamentals, but by shifts in global capital flows, investor sentiment, and geopolitical developments.

Pictured: Kelly Vlug - Quantitative Analyst* at Prescient Investment Management

In periods of heightened uncertainty, the rand can "blow out" as investors retreat to perceived safety by investing in more stable assets, such as the US dollar or government bonds from developed economies. The sharp depreciations are not solely a function of local economic issues but are also significantly influenced by the prevailing global sentiment.

One of the primary drivers behind the rand’s recent weakness is Trump’s tariff rhetoric, which has unsettled global markets. In today’s interconnected world, the repercussions of aggressive tariff policies are not confined to the origin country; they ripple through every link in the chain. His statements have sparked concerns over a potential escalation in trade tensions - particularly with major economies like China - leading to a broader risk-off environment. As a high-beta currency, the rand is especially vulnerable during these global sentiment shifts. The resulting capital outflows from South African assets amplify the currency’s volatility, contributing to sharp depreciations.

Despite periodic shocks, history has shown that the rand tends to recover - often swiftly - highlighting its underlying resilience. At Prescient Investment Management (Prescient), we leverage robust quantitative models to evaluate the rand’s performance. The primary drivers of our market outlook are valuations, economics, financial conditions and sentiment.

Prescient’s valuation models, primarily influenced by the real effective exchange rate and the real interest rate differential, currently reflect a strongly positive outlook for the rand. The real interest rate differential is calculated by subtracting inflation from nominal interest rates in two countries and comparing the resulting real rates. While South African inflation and US inflation stand at 3.2% and 2.4%, respectively, the South African nominal rate is 11% whereas the US nominal rate is 4.5%. A favourable differential of approximately 5.7% for South Africa supports a stronger rand outlook. For local and foreign investors alike, these elevated real yields create a compelling case for reinvestment into South African assets, which over time should increase capital inflows and strengthen the rand.

Economic conditions continue to support a positive view on the rand. This is largely attributed to the strength of industrial metals - a key component of South Africa’s export basket. Elevated prices in metals, such as platinum group metals (PGMs), iron ore, and manganese have significantly boosted export revenues, enhancing the rand’s fundamental value. This strength is particularly relevant in the current global environment, where trade tensions and tariff structures remain prominent. Notably, South Africa’s commodity exports have been somewhat shielded from the full brunt of global tariffs. Many of the country’s core exports - including precious metals and certain industrial commodities - fall under categories that are either exempt from tariffs or subject to less aggressive trade restrictions. This has helped sustain export competitiveness and soften the potential negative impact of protectionist policies globally. As a result, while other export-driven economies may experience greater headwinds, South Africa stands to benefit from its favourable export mix and the continued global demand for key resources - reinforcing a constructive view on the rand.

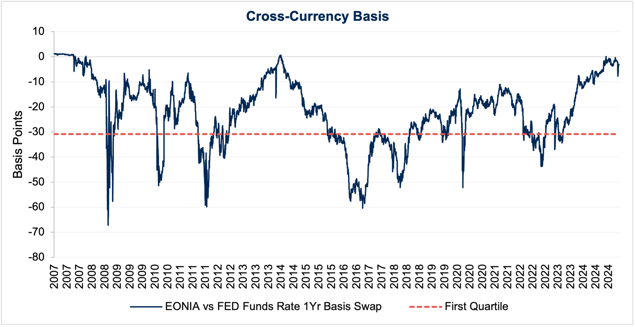

Financial conditions are partly driven by the cross-currency basis, which presents a strongly positive outlook for the rand. The cross-currency basis describes the basis spread added to the Secured Overnight Financing Rate (SOFR) when the US Dollar is funded via foreign exchange swaps using the Euro as a funding currency. A widening of the spread is usually driven by a shortage of US Dollars in the market. The spread currently stands at approximately -3.4 bps, above its first quartile value of -30.8 bps. A tighter basis indicates global liquidity and hence increased investment into emerging markets like South Africa, leading to a stronger rand. The chart below shows the history of the cross-currency basis.

Sentiment on the rand is mixed. Business and investor sentiment remains positive, underpinned by resilient fundamentals, but is offset by weaker consumer sentiment. As a result, sentiment factors currently depict a neutral outlook on the rand.

Overall, Prescient’s models reflect a moderately positive assessment for the rand - supported by strong valuation signals and economic fundamentals, with financial and sentiment indicators providing a more neutral contribution.

For investors and market watchers, the erratic movements of the rand serve as both a cautionary tale and an opportunity. The currency’s tendency to suffer during global risk-off phases reminds market participants to remain vigilant and consider the broader economic context. Conversely, its propensity to recover once stability returns can provide enticing entry points for those with a long-term perspective. Ultimately, understanding the nuances behind the rand’s volatility can help investors navigate the complexities of emerging market investments with a more informed and strategic approach. At Prescient Investment Management, we take a holistic view to assess the rand’s performance and guide investment decisions with precision and insight.

Disclaimer:

Prescient Investment Management (Pty) Ltd is an authorised Financial Services Provider (FSP 612). Please note that there are risks involved in buying or selling a financial product, and past performance of a financial product is not necessarily a guide to future performance. The value of financial products can increase as well as decrease over time, depending on the value of the underlying securities and market conditions. There is no guarantee in respect of capital or returns in a portfolio. No action should be taken on the basis of this information without first seeking independent professional advice. *Representative acting under supervision.

The information contained herein is provided for general information purposes only. The information and does not constitute or form part of any offer to issue or sell or any solicitation of any offer to subscribe for or purchase any particular investments. Opinions and views expressed in this document may be changed without notice at any time after publication and are, unless otherwise stated, those of the author and all rights are reserved. The information contained herein may contain proprietary information. The content of any document released or posted by Prescient is for information purposes only and is protected by copy right laws. We therefore disclaim any liability for any loss, liability, damage (whether direct or consequential) or expense of any nature whatsoever which may be suffered as a result of or which may be attributable directly or indirectly to the use of or reliance upon the information. For more information, visit www.prescient.co.za.