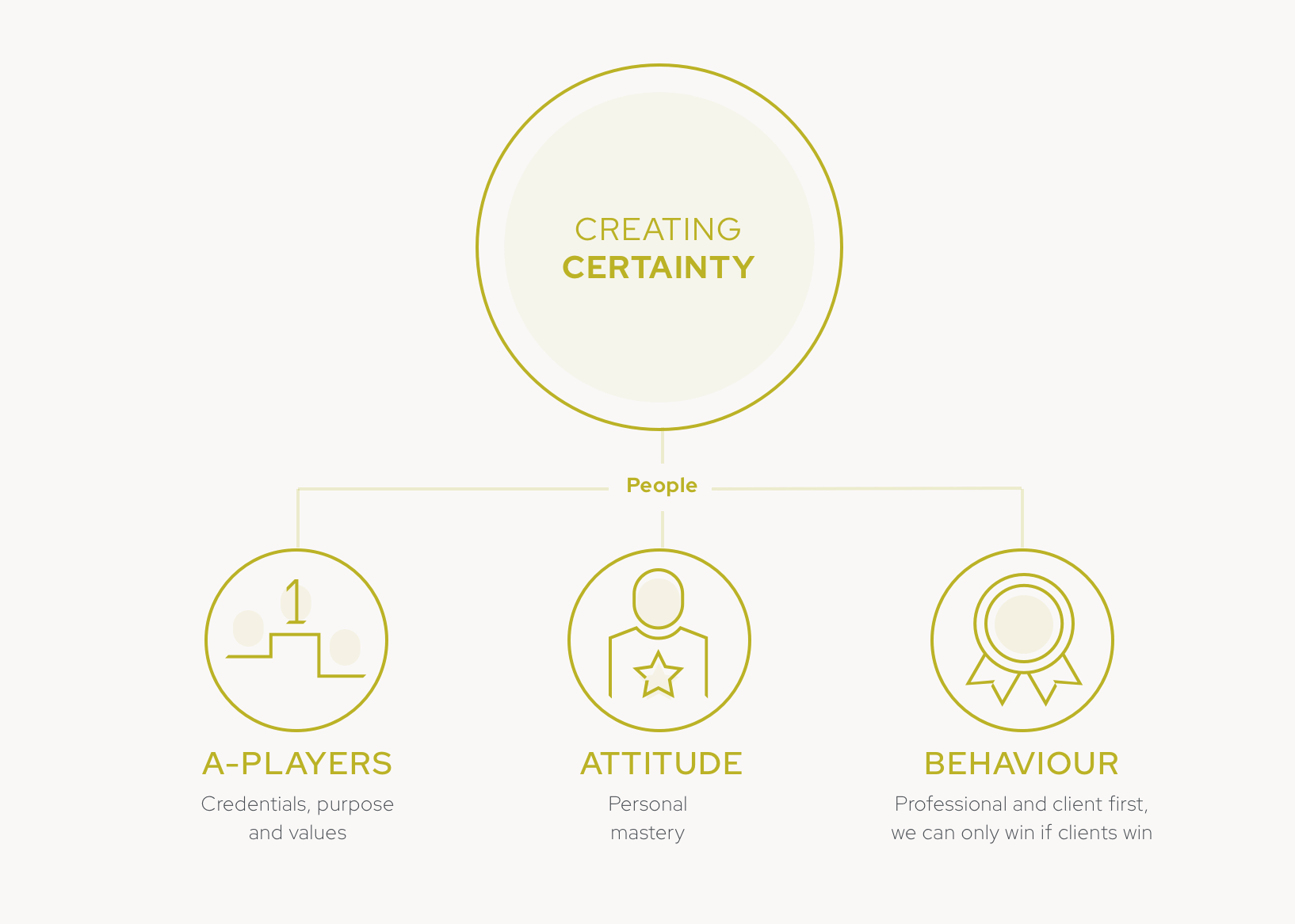

We hire for talent and skills and embrace new ways of doing things and lessons learned with humility and open minds.

Our team of A-players thinks innovatively and engages in rigorous debate, based on facts, to provide our clients with solutions that give comfort and the knowledge that they are in expert hands.

Prescient Group Chairman

Executive Director & Prescient Group CEO

Executive Director & Prescient Investment Management CEO

Non-Executive Director & Prescient Investment Management Chairman

Non-Executive Director

Non-Executive Director & Prescient Investment Management Chairman

Executive Director & Prescient Investment Management CEO

Executive Director

Prescient Group Chairman

Executive Director & Head of Institutional

Executive Director & Prescient Investment Management CIO

Non-Executive Director

Non-Executive Director

Executive Director & Prescient Securities CEO

Executive Director & Prescient Securities COO

Executive Director & Prescient Group CEO

Non-Executive Director

Executive Director & Prescient Fund Services CEO

Executive Director & Prescient Group CEO

Executive Director & Prescient Fund Services COO

Non-Executive Director

Prescient Group Chairman

Non-Executive Director

Executive Director & Prescient Fund Services CEO

Executive Director & Prescient Fund Services Ireland CEO

Executive Director & Prescient Fund Services Ireland Chief Risk Officer

Executive Director & Prescient Fund Services Ireland COO

Prescient Group Chairman

Non-Executive Director

Non-Executive Director

Prescient Group Chairman

Executive Director & Prescient China CEO

Non-Executive Director

Non-Executive Director

Non-Executive Director

Non-Executive Director

Non-Executive Director

Non-Executive Director

Executive Director, Prescient Management Company CEO & Prescient Fund Services Head of Product

Executive Director & Prescient Fund Services CEO

Non-Executive Director

Non-Executive Director

Want to join a team of hard working but balanced, fun, high-performing individuals who love what they do and who strive to make a significant difference in our environment?

We believe in partnering with like-minded people, enabling you to thrive, be happy and meet your growth potential.

View Our Open OpportunitiesDo you have a strong academic record, leadership ability, a history of achievement and a passion for Financial Markets?

If so, the Prescient Graduate Programme may be just right to elevate your career in the Financial Markets industry.

Learn More